The city is a thriving trade hub that beckons ambitious entrepreneurs like you. Hence, we created a guide that equips you with the knowledge and steps to navigate the process of import-export company formation in Dubai.

Why Dubai? Because of its strategic location, world-class infrastructure, and business-friendly environment. These factors make it an ideal launchpad for your import-export business.

But that’s not all! Dubai and the entire UAE are major trading hubs. Let’s explore the dynamics of Dubai’s non-oil foreign trade and its impact on the wider UAE.

- Dubai Customs Data: It offers comprehensive statistical reports, providing a deep dive into the city’s non-oil trade. These reports detail import, export, and re-export figures, giving valuable insights into Dubai’s trade activity. Here’s a quick view.

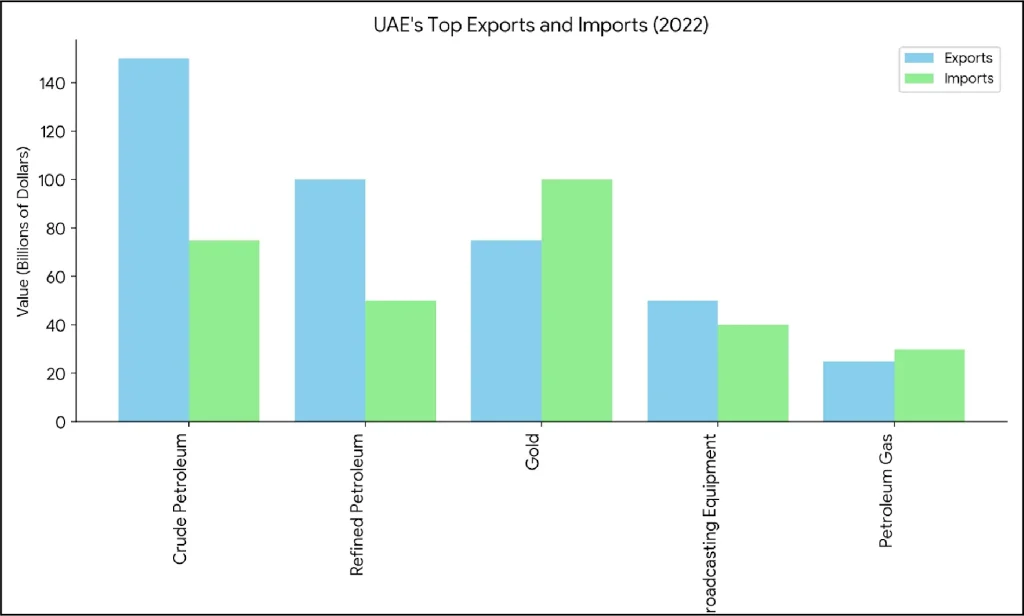

- UAE’s Global Trade Prowess: The UAE, encompassing Dubai and other emirates, has established itself as a major player on the world stage. In 2022, the UAE ranked 18th globally for exports and 21st for imports.

The total value of UAE exports reached a staggering $402 billion, while imports stood at $312 billion. Dubai plays a significant role in contributing to these impressive figures.

- Top Products Traded: Both Dubai and the wider UAE actively trade in a variety of goods. Leading exports include crude petroleum, refined petroleum, gold, broadcasting equipment, and petroleum gas.

On the import side, gold, broadcasting equipment, refined petroleum, diamonds, and cars are the most common.

- Trading Partners: When it comes to exports, Dubai and the UAE find key destinations in India, Japan, China, Saudi Arabia, and Iraq. For imports, China, India, the United States, the United Kingdom, and Saudi Arabia are the main sources. Dubai’s strategic location and business-friendly environment make it a natural hub for trade with these regions.

- A Thriving Trade Balance: The UAE enjoys a positive trade balance, meaning the value of exports exceeds imports. In 2022, the UAE exported a total of $425.16 billion compared to imports of $347.53 billion, resulting in a surplus of $77.63 billion. Dubai’s contribution to this positive balance sheet is significant, solidifying its position as a vital trade engine within the UAE.

The Role of Dubai Customs Registration While Setting an Import-Export Business in Dubai

Before your import-export dreams set sail, there’s one crucial step: Dubai Customs registration. Think of it as your official import-export license; it empowers you to legally bring goods in and out of Dubai, ensuring you comply with regulations set by Dubai Customs.

This registration safeguards your business and avoids any potential penalties or delays that could disrupt your regional operations.

Step-By-Step Guide to Navigate the Import Export Company Registration Process in Dubai Smoothly

1. Market Research: Charting Your Course

Imagine this, you have secured a shipment of the latest fitness trackers, only to discover Dubai’s fitness enthusiasts have already moved on to smartwatches. Thorough market research prevents such pitfalls.

It’s like having a compass you analyze trends, identify products with high demand, and understand potential challenges. This way, you import goods that resonate with Dubai’s dynamic market, maximizing your chances of success.

Check for governmental data, valuable resources, research reports, and expert insights to help you steer your import-export venture in the right direction.

2. Choosing Your Business Structure:

Think of this as laying the foundation for your import-export venture. Dubai offers several options:

- Free Zone Company: Ideal for 100% foreign ownership and enjoying tax benefits. However, it may have restrictions on where you can conduct business within Dubai.

- Onshore Company: Partnering with a local sponsor grants access to the entire UAE market. This option requires specific arrangements with your sponsor.

- Offshore Company: If you plan to focus on international trade and don’t require a physical presence in Dubai then offshore company formation in Dubai is the way to go.

3. Selecting a Trade Name:

Your trade name is your identity in the marketplace. Choose a unique and catchy name that reflects your brand and complies with UAE regulations.

4. Obtaining the Right Business License:

Dubai issues different licenses depending on your business activity. Will you be a trading powerhouse dealing in various goods (commercial license), or a manufacturer bringing innovative products to market (industrial license)?

5. Gearing Up with Essential Documents:

Imagine your shipment arriving at Dubai’s port, only to be held up due to missing paperwork. Obtaining the necessary licenses and permits ensures your import-export journey runs smoothly. Think of them as your ship’s navigation charts they help you avoid regulatory hurdles and navigate customs clearance efficiently.

CorpCreators can advise you on the specific licenses and permits required based on your chosen products and business activities. From a well-defined business plan outlining your import-export strategy to gathering the necessary documents, we can assist you with everything!

6. Securing Approvals:

Think of approvals as obtaining necessary clearances before takeoff. You’ll need approval from the DED, the Ministry of Economy, and potentially other relevant authorities, depending on your business activities.

7. Joining the Dubai Business Community:

Welcome aboard! Registering with the Dubai Chamber of Commerce and Industry connects you to a network of fellow entrepreneurs and resources to support your import-export endeavors.

8. Establishing Your Business Address:

Dubai requires a physical office space for registration. This could be a dedicated office or a flexible co-working space, depending on your needs.

9. Setting Up Your Business Bank Account:

Just like any business, your import-export operation needs a reliable financial anchor. Setting up a dedicated business bank account allows you to manage your finances efficiently.

It facilitates secure transactions, receiving payments from international clients, and paying your suppliers seamlessly. Think of it as your safe harbor, ensuring your financial transactions are secure and transparent.

10. Final Touches: Registration and Licensing:

11. Obtaining Additional Clearances and Visas:

If you plan to hire employees, ensure they have the necessary clearances and visas to work in Dubai.

Important Documentations and Procedures You Need to Know Before Starting an Import-Export Business in Dubai

1. Documents Required:

Import-export businesses are required to adhere to various documentation requirements, such as;

- Invoices,

- Packing Lists,

- Certificates Of Origin,

- Shipping Documents.

These documents facilitate the smooth flow of goods through customs and ensure compliance with import-export regulations.

2. Clearing Goods Through Dubai Customs:

From prepping yourself to securing customs fees, and cooperating with Inspections Familiarize yourself with the process to keep your business running.

3. Compliance with Import-Export Regulations:

Import-export businesses must comply with the regulations governing international trade, including import-export restrictions, customs duties, and tariffs. Staying updated with the latest regulations is important to avoid legal issues.

Customs Duties, Taxes & VAT in Dubai for Import-Export Businesses

Imagine your first shipment arriving at Dubai’s port. Customs duties and tariffs are like tolls you might encounter on a trade route. These government-imposed charges help regulate trade and generate revenue. Knowing the applicable duties and tariffs for your products empowers you to:

- Estimate Costs Accurately: By understanding these charges upfront, you can factor them into your pricing strategy and avoid surprises later.

- Stay Competitive: With a clear understanding of import and export costs, you can price your goods competitively in the Dubai market.

Optimizing Your Taxes:

Minimizing import-export taxes is like finding hidden shortcuts on your trade route. Here are some strategies to explore:

- Duty-Saving Schemes: Free trade agreements (FTAs) between the UAE and other countries can significantly reduce or eliminate duties on specific goods. Explore these opportunities to save on costs.

- Customs Duty Exemptions: Qualifying businesses may be eligible for customs duty exemptions on certain imported goods. Research available exemptions to see if you qualify.

- Duty Drawback Programs: In some cases, you may be able to claim a refund of duties paid on imported materials if you use them to manufacture exported goods. Investigate duty drawback programs to see if they benefit your business.

Understanding VAT in Dubai:

VAT is a tax levied on the value added to goods and services at each stage of production and distribution. Here’s what you need to know:

- VAT Registration: If your import-export business deals in taxable goods and services (including imported goods and re-exports), you will need to register for VAT.

- VAT Rates: The standard VAT rate in Dubai is 5%. However, certain goods and services may be exempt or subject to a different rate.

- VAT Compliance: Import-export businesses must charge the appropriate VAT rates on taxable supplies and file VAT returns in compliance with the regulations set forth by the Federal Tax Authority (FTA).

Remember:

We at Corp Creators can help you determine the specific duties and tariffs applicable to your products or even connect you with the right people before you set up shop!

With us consult customs experts and tax advisors to identify opportunities for tax optimization and cost savings specific to your import-export operations. We can offer guidance on VAT registration and compliance. Don’t hesitate to leverage our expertise!

How Much Does It Cost to Register an Import-Export Business in Dubai?

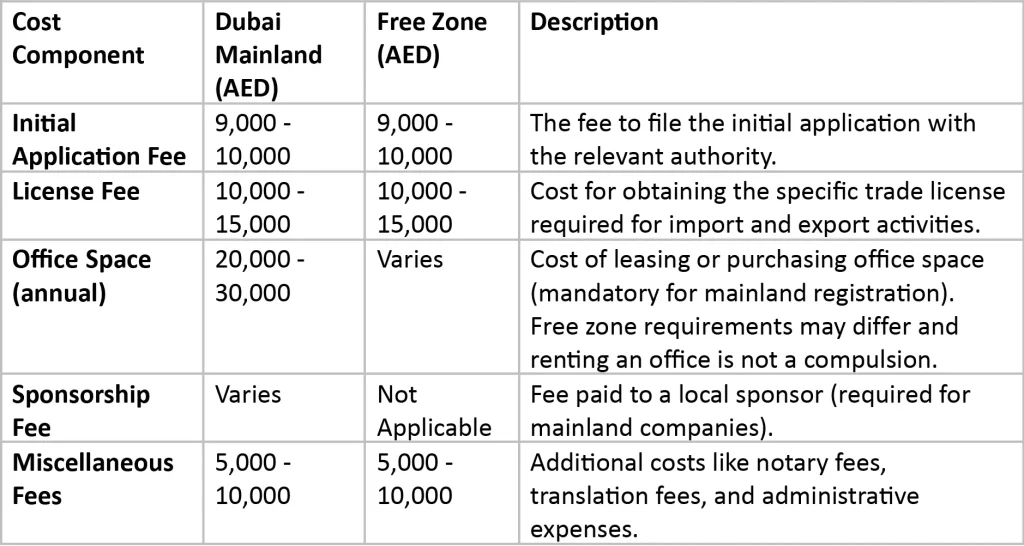

The cost of import-export company formation in Dubai can vary depending on a few factors:

- Location: Will you operate on the bustling Dubai mainland or in a specialized free zone? Mainland registration tends to be slightly more expensive.

- Visa Needs: Do you need visas for employees? The number of visas you require can impact the registration cost.

- Specific Business Requirements: Depending on your business activities, there might be additional fees involved.

Here's A Snapshot Of Estimated Costs:

- Dubai Mainland: Expect the import-export license application fee to start at around AED 24,000.

- Dubai Free Zones: Free zones can offer more cost-effective options. In some zones, the application fee can be as low as AED 12,500 if you don’t require visas.

Here’s A Possible Breakdown Of The Costs Involved:

Keep in Mind:

These are estimates and may fluctuate.

For the most up-to-date and precise pricing information, it’s always recommended to consult Corp Creators – the best business setup consultants in Dubai.

By getting expert advice, you can ensure you have a clear picture of the costs involved in launching your import-export venture in Dubai.

So, what are you waiting for? Book a free consultation today!