Working from home has become a normal practice after COVID-19. Not just employees or professionals, but several entrepreneurs also choose to conduct business from home. And why wouldn’t they? Having a business setup at home saves time and is super cost-effective.

Earlier, it was illegal in Dubai to have a business setup from home. Home-based businesses in Dubai could not be licensed; they were treated as illegitimate and confiscated. On the other hand, only UAE nationals could apply for an Intelaq license, which permitted them to conduct any home-based business that was not harmful.

However, the Intelaq license also came with several restrictions and was considered valid only after three years of doing business. Things shifted in the UAE, and the concept of working remotely surged in popularity in the post-COVID-19 era.

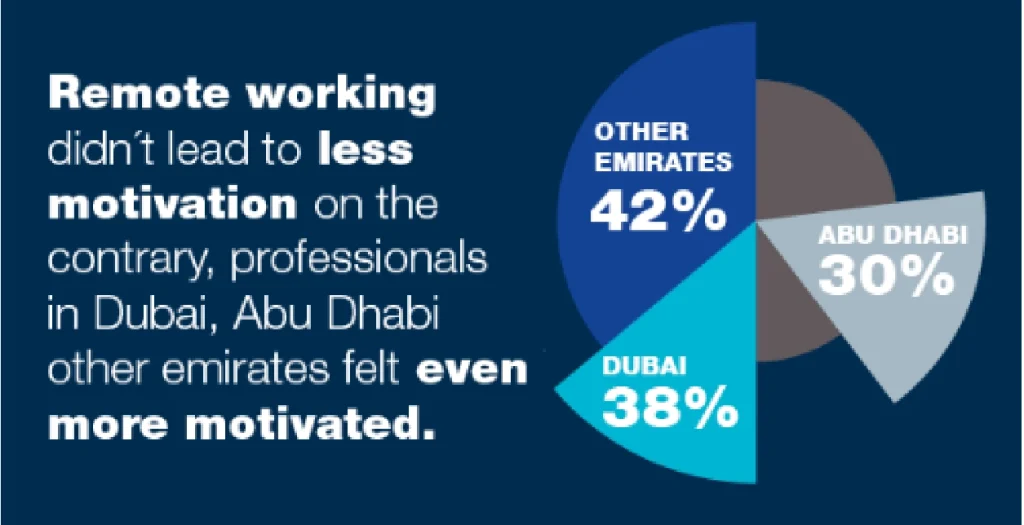

A study by Michael Page in The Middle East found limited work-from-home options in pre-COVID times – only 13% in Dubai, 18% in Abu Dhabi, and 15% in other emirates. However, lockdowns dramatically shifted this: over 62% worked remotely in Dubai, 51% in Abu Dhabi, and 56% in other emirates. This also motivated entrepreneurs to shift their businesses home.

Dubai, a city synonymous with innovation, embraced the work-from-home trend by recognizing its potential. Understanding that small and medium-sized enterprises (SMEs) form the backbone of the UAE’s economy, which is a whopping 95%, they permitted home-based and micro businesses.

With this exciting development, expatriates and UAE nationals could now pursue their entrepreneurial dreams from home! Currently, Dubai categorizes home-based ventures as micro businesses. They are defined as companies with a limited headcount (fewer than nine employees in the trading sector or 20 in the services sector) and a specific revenue threshold (under Dh9 million in trading or Dh10 million in services).

Dubai's Booming Home-Based Businesses: Numbers Tell the Story

There’s an exciting buzz in the world of Dubai entrepreneurship, and it’s emanating from home offices! Here’s a glimpse into the trend with some compelling figures:

1. Exponential Growth:

The number of home-based businesses is skyrocketing, with an annual increase of up to 6%. This surge reflects a growing desire for flexible work arrangements and the power to launch a business from your own home. Imagine, turning your passion project into a reality without needing a fancy office!

The beauty of this trend? You can choose to operate from anywhere in the world. For those seeking a dynamic and business-friendly location with a streamlined process, Dubai offers a particularly attractive option for home-based business setup in Dubai. This allows you to tap into a global marketplace while enjoying the flexibility and convenience of a home office.

2. Affordability Advantage:

Let’s face it, starting a business can be expensive. But the beauty of home-based businesses is their affordability. The majority can be launched with a trade license costing around Dh1,070. This low barrier to entry allows aspiring entrepreneurs to test the waters and build their dream business without breaking the bank. Test, learn, and grow within the comfort of your home!

3. Government Backing You Up:

The good news doesn’t stop there! The UAE government is a strong advocate for home-based businesses, especially those offering services like marketing. A Dh500 million initiative specifically supports Dubai-based SMEs to expand globally. Imagine the possibilities – government resources to help you take your home-based business to the world!

So, How Do You Start A Home-Based Business In Dubai?

Step 1: Define Your Business Concept

Carefully define the nature of your business activity. Consider your skills, market demand, and alignment with Dubai’s economic ecosystem. Explore resources like the Dubai Startup Hub or the Dubai Chamber of Commerce, among others, to spark your entrepreneurial vision.

Step 2: Register Your Business Name

Develop a catchy and distinctive trade name that resonates with your target audience and accurately reflects your business offerings. Now, head to the relevant authorities to officially register your chosen business name.

Step 3: Secure Your Home Office

While flexibility is a key benefit, designate a dedicated workspace within your home to foster productivity and maintain a professional environment. Invest in essential equipment and create a space that motivates and inspires you.

Step 4: Verify Location Compliance

While Dubai encourages home-based businesses, some areas may have specific zoning regulations. Verify compliance with your local authorities to avoid any potential roadblocks in the setup process.

Step 5: Obtain the Necessary License

The Department of Economic Development (DED) is crucial to licensing business activities. Submit the necessary documents and obtain approval for your chosen business activity. This paves the way for acquiring a home-based business license, essential for legal operation.

This single license covers everything you need, from legal permission to operate your SME to Dubai Chamber membership. It also offers you banking benefits and a “Customer Client Code” from Dubai Customs and Facilities, which is essential for import and export businesses.

Step 6: Obtain an FAIC Business Card

Step 7: Secure Memberships

Secure memberships with two key organizations:

- Ministry of Human Resources and Emiratisation (MoHRE): This membership allows you to hire employees legally if your business requires them.

- Dubai Chamber of Commerce: Membership connects you to the wider business community, offering valuable support and networking opportunities.

Step 8: Manage Your Finances

A home-based business offers the possibility of bank account opening in UAE. So, open a dedicated business bank account to maintain financial clarity. This facilitates accurate expense tracking and simplifies financial management.

Step 9: Develop a Strategic Marketing Plan

Craft a comprehensive marketing plan to reach your target audience and promote your business effectively. Network with potential clients and other businesses to leverage Dubai’s vast opportunities.

Step 10: Understand Tax Obligations

While Dubai boasts a tax-friendly environment, familiarization with Value Added Tax (VAT) registration is essential if your business turnover exceeds the designated threshold.

Step 11: Seek Professional Guidance

Consider collaborating with a company formation expert in Dubai. Their expertise can ensure a smooth setup process and provide valuable advice throughout your entrepreneurial journey.

How To Maintain A Compliant Home-Based Business In Dubai?

Running a home-based business in Dubai offers numerous advantages, but it’s crucial to operate within the legal framework. Here are some key areas to ensure your home business stays compliant:

1. Zoning Regulations:

Not all residential areas allow home-based businesses. Check with your local authorities or community management to confirm if your area permits home businesses and any specific regulations they may have.

2. Signage and Advertising:

While promoting your business is important, some communities might restrict external signage or advertising for home businesses. Research these guidelines to avoid any violations.

3. Visa Regulations:

If you or your employees require visas, ensure you follow the proper regulations for obtaining and renewing them. Maintaining valid visas is essential for legal operation.

4. Tax Compliance:

Even though Dubai boasts tax advantages for businesses, you need to manage your taxes responsibly. Understand any potential tax obligations and ensure accurate financial management.

- No Personal Income Tax: Dubai does not levy personal income tax, which includes earnings from home-based businesses.

- Corporate Tax: As per the Ministry of Finance, a corporate tax (CT) is introduced with rates of 0% for taxable income up to AED 375,000 and 9% for taxable income above AED 375,000. However, this is generally applicable to larger corporations, and specific criteria are set for multinational companies.

- VAT Registration: If the annual turnover of your home-based business in Dubai exceeds AED 375,000, it must register for Value Added Tax (VAT) at the standard rate of 5%.

- Rental Tax: For businesses operating from rented properties, residential tenants pay 5% of their annual rent as rental tax, while commercial tenants pay 10% in Dubai.

5. Intellectual Property and Licensing:

If your business involves unique creations or requires specific licenses to operate, protect yourself. Register trademarks and patents or obtain the necessary licenses to avoid legal complications.

Home-Based Venture: The Perfect Low-Cost Business Setup in Dubai

It is surely a low-cost option compared to traditional businesses because you don’t need to rent office space. All you need is a trade licence, which costs around Dh1,070. On average, microbusinesses cost around $3,000 (Dh 11,018) to start.

However, there are different types of costs to consider, including one-time vs. ongoing, essential vs. optional, and fixed vs. variable costs.

It’s important to analyze your cash flow like any other traditional business. This will ensure you have enough money to cover your expenses. Experts recommend starting small and investing conservatively.

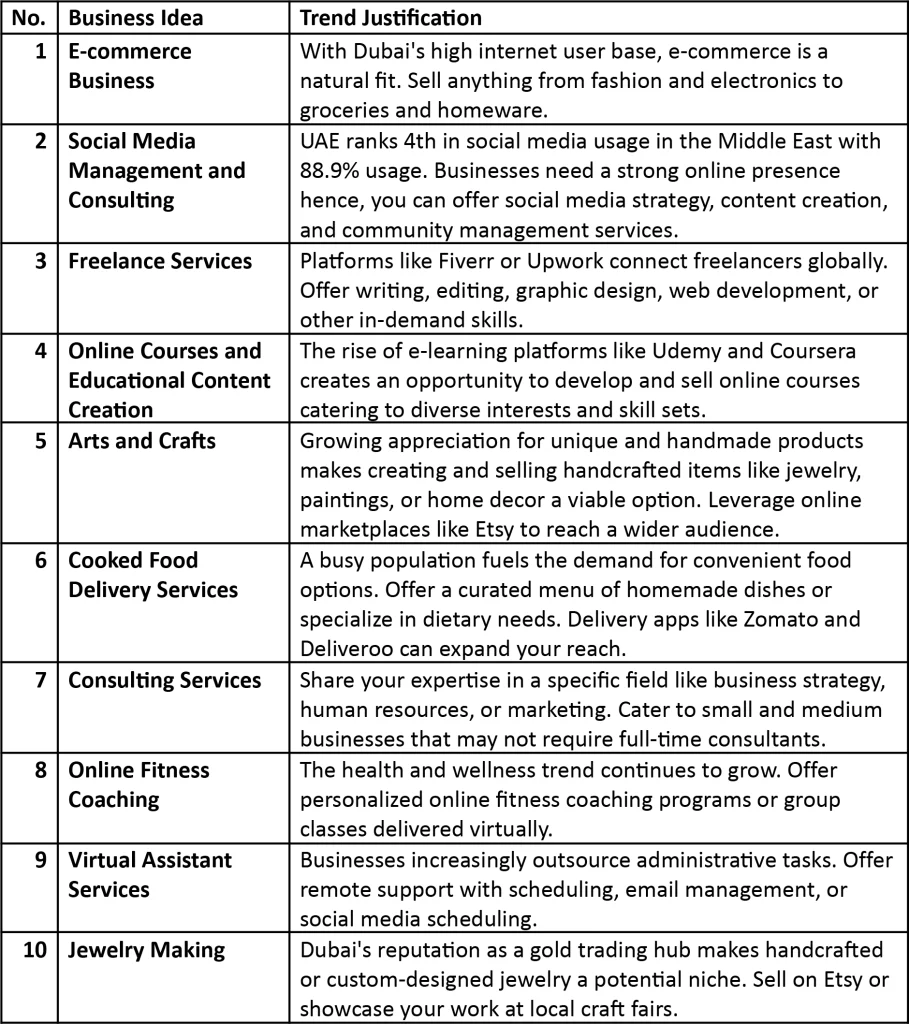

Top 10 Trending Home-Based Business Ideas In Dubai and Why They Are Trending:

Ready For A Smooth Takeoff

Home-based business in Dubai is a fantastic way to turn your passion into profit, and the city offers a supportive environment for entrepreneurs. However, before you dive in, let’s ensure a smooth takeoff by addressing a few key points:

Business Permits: Beyond the Licensing and Paperwork

While a business license simplifies the process, it might not be the only permit you need. Activities like food preparation or operations that generate noise or odors may require additional approvals from Dubai Municipality or relevant authorities. For example, selling food or beverages necessitates separate permits from Dubai Municipality. Similarly, businesses involving alcohol may need additional licensing from the Alcohol Licensing Department.

Understanding these regulations can feel overwhelming, but don’t worry! Here at CorpCreators, we specialize in helping entrepreneurs like you navigate the legalities of starting and running a home-based business in Dubai.

Let's Turn Your Dream into Reality

We offer a free consultation to discuss your specific business needs and ensure you have all the necessary permits and approvals in place.

Ready to launch your home-based business and join Dubai’s thriving entrepreneurial scene? Contact CorpCreators today and let us help transform your dream into a successful reality!

Book a free consultation right away!