The UAE insurance market is projected to soar to an impressive USD 9.44 billion by 2024, signaling a flourishing industry. This growth is mainly driven by the non-life insurance segment, which is expected to reach USD 5.57 billion in 2024.

With the rising insurance penetration rate, the UAE has a growing customer base. This evolution signifies increased demand for diverse insurance products and a richer opportunity for such businesses.

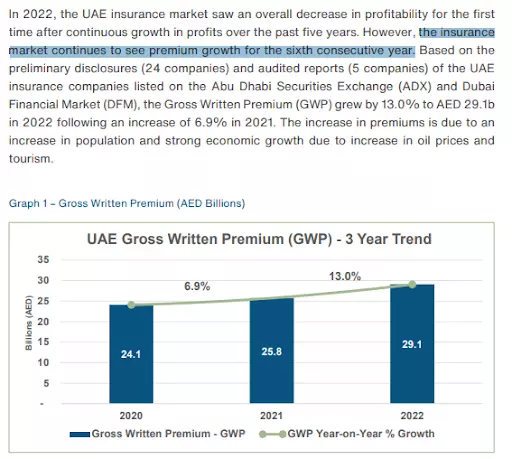

The insurance sector is a pillar of the UAE’s economic prosperity in terms of economic significance. Its substantial contribution to the GDP underscores its vital role in the national financial landscape, as shown in the UAE Insurance Industry Report above.

Also, anticipated average per-person insurance spending in the UAE reflects a strong consumer commitment to investing in valuable insurance solutions. Moreover, with the UAE Central Bank at the helm, a transparent and fair market environment is secured for insurance businesses, fostering trust and promoting ethical practices throughout the industry.

Take note that;

- It is a competitive space: The marketplace has established local and international players. The strong presence of major insurance companies, alongside a growing number of smaller, specialized firms, creates a dynamic and exciting arena for innovation.

- But there are greater profitability considerations: As business volumes rise, it’s essential to navigate the competition strategically to ensure long-term profitability in this evolving industry.

In conclusion, the Dubai insurance sector has potential for new enterprises. With a growing market, increasing consumer demand, and a stable regulatory environment, this field holds immense promise for success. Embracing this challenge with courage and vision will be key to unlocking its rewards.

Now, That You Know How Advantageous This Sector Is, How Do You Start an Insurance Business in Dubai? And Why Should You Prefer Mainland?

Steps to Start an Insurance Business in Dubai:

- Choose the Correct Business Activity: Decide whether you’ll offer health, life, property, or other types of insurance.

- Select Your Jurisdiction: Decide whether to set up on the mainland or in a free zone. Mainland companies can trade freely within Dubai and the UAE.

- Determine Your Business Structure: Choose a legal structure, such as a sole proprietorship, partnership, or LLC.

- Register Your Company Name and Obtain Approvals: Register your company name and get initial approvals from the Department of Economic Development (DED).

- Apply for Your License: Apply for the necessary insurance license from the Central Bank of the UAE (CBUAE).

- Rent Office Space: Secure office space in Dubai.

- Get Approval from CBUAE: Obtain final approval from the Central Bank.

Obtaining CBUAE Approval for Insurance Companies in Dubai, UAE

Securing approval from the UAE Central Bank (CBUAE) is a mandatory step for establishing an insurance business setup in Dubai Mainland. Here’s a simplified breakdown of the process:

- Electronic Application:

- Access the CBUAE online system using valid login credentials. New users can request credentials via email.

- Submit your application electronically, ensuring it’s complete and accurate.

- Form Completion and Document Upload:

- Carefully fill out the designated service form.

- Upload all required documents within the electronic system.

- Review and Approval:

- CBUAE staff will assess your application for completeness and adherence to regulations.

- You will receive a notification regarding the approval or rejection of your application.

- Official Gazette Publication:

- Upon successful approval, your licensing decision will be officially published in the UAE’s Official Gazette.

- License Fee:

- Settle the one-time licensing fee of AED 20,000 to receive a printed copy of your official approval.

Important Note:

While this outline provides a general overview, it is strongly recommended to seek professional guidance throughout the process – and speak to a business setup consultant in Dubai from CorpCreators. This will ensure seamless navigation and compliance with all regulatory requirements.

Additional Tips:

- Start early to allow ample time for the application process.

- Prepare all necessary documents in advance.

- Engage a reputable legal and financial advisor to assist you.

- Be prepared for potential delays and additional documentation requests.

By following these steps and seeking expert advice, you can successfully obtain CBUAE approval and establish your insurance company in Dubai.

Types of Insurance Businesses Allowed in Dubai, UAE

Dubai’s thriving insurance market offers a variety of opportunities for professionals and businesses. Here are some of the key types of insurance businesses you can establish in Dubai:

Type of Insurance Business | Description |

Loss & Damage Adjusters | Evaluate and settle insurance claims efficiently. |

Insurance Companies | Offer diverse risk coverage solutions across various sectors. |

Actuaries | Assess liabilities, design sustainable insurance products, and manage risk. |

Insurance Agents | Represent specific insurance companies and sell their policies. |

Insurance Consultants | Provide tailored risk management and mitigation advice to clients. |

Insurance Brokers | Represent clients’ interests and secure optimal coverage across multiple insurance providers. |

Know that setting up an insurance firm in Dubai requires initial registration with the Dubai Economic Department (DED) followed by obtaining a license from the Insurance Authority. Our experienced company incorporation specialists in Dubai can guide you through this process, ensuring your operating license aligns with your chosen service offerings.

Why Mainland Company Setup is Better for Insurance Business in Dubai?

While both mainland and free zone companies offer distinct advantages for businesses in Dubai, for an insurance company, a mainland company structure often proves to be a more suitable option. Here’s why:

Key Advantages of Mainland Company for Insurance Business:

- Wider Market Access:

- Local Market: Mainland companies can operate anywhere within the UAE, allowing them to tap into the entire local market. This is crucial for an insurance business as it allows for direct interaction with clients and building a strong local presence.

- International Market: While international business is possible from free zones, a mainland company can directly engage in international business activities without the need for a local agent.

- Stronger Brand Reputation:

- A mainland company is perceived as a more established and reputable entity, which can be particularly important for an insurance business that relies on trust and credibility.

- Enhanced Client Relationships:

- Direct interaction with clients, especially for claims and other services, is easier with a mainland company. This fosters stronger client relationships and builds trust.

- Easier Bank Account Opening:

- Mainland companies generally find it easier to open bank accounts in the UAE, which is essential for financial transactions and operations.

- Flexibility in Business Activities:

- Mainland companies offer more flexibility in the range of activities they can undertake, ensuring that your insurance business can adapt to changing market conditions and diversify its offerings.

Considerations for Mainland Company Setup:

- Higher Initial Costs: Mainland companies typically require higher initial setup costs compared to free zone companies.

- Corporate Tax: While there are tax benefits for small and medium-sized enterprises, mainland companies may be subject to corporate tax after a certain income threshold.

- Local Partner Requirement: In certain cases, a local partner may be required, but this is often not a significant hurdle.

In conclusion, while free zones offer certain advantages, a mainland company structure provides a more comprehensive and flexible platform for an insurance business in Dubai. By carefully considering the specific needs and long-term goals of your insurance business, you can make an informed decision about the most suitable legal structure.

It’s recommended to consult with CorpCreators legal and business experts to get tailored advice based on your specific requirements.