Let’s Start by Understanding Why Exactly Dubai Has Special Economic Zones And Segregated Jurisdictions?

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

- Economic Growth: Mainland as well as Free zones are designed to promote economic diversification and drive sustainable growth. They are pivotal in transforming Dubai into a global and regional investment hub.

- Foreign Investment: These zones aim to attract domestic and foreign investments by offering unique incentives, regulations, and infrastructure tailored to specific industries.

- Competitive Business Environment: Mainland regions as well as Free Zones provide a competitive business environment with streamlined procedures, reduced costs, and tax exemptions, making them attractive for business operations.

- Industry Activation: They stimulate the growth of industry within the zone, providing the local market with quality products and goods, and developing international trade and foreign economic relations.

- Investment Incentives: Companies in SEZs enjoy benefits such as 100% foreign ownership, no currency regulations, and financial transactions ease, which are crucial for international investors in Dubai and across the UAE.

- Labor and Asset Movement: Dubai does not have strict restrictions on the movement, withdrawal, and distribution of investment assets and income, which is beneficial for businesses looking to operate internationally.

In essence, SEZs and segregated jurisdictions in Dubai are established to catalyze industry-specific development, enhance the city’s economic profile, and create an environment conducive to business and investment from around the world. They are a foundation of Dubai’s vision to maintain its status as a leading economic powerhouse.

Why Is Deciding Between a Dubai Free Zone And A Mainland Business Setup So Critical?

- The Regulatory Environment: Free Zones boast a more relaxed environment with simplified procedures and tax breaks, ideal for certain businesses. Mainland companies, however, adhere to stricter federal and local regulations, offering wider market access in exchange.

- Ownership and Control: Free Zones grant foreign investors complete ownership, eliminating the need for a local sponsor. This is perfect for those seeking full control. While the Dubai Mainland Company Setup now allows 100% foreign ownership in many sectors, some activities may still require a local partner, impacting control and profitability.

- Market Access: Mainland companies enjoy the freedom to operate across the UAE, including direct access to the local market. Free Zone companies typically operate within their designated zone and internationally, unless they acquire additional licenses or partner with local distributors.

- Visa and Office Requirements: The Mainland imposes no restrictions on the number of visas a company can apply for, but requires a physical office space. Free Zones often have limitations on visas but offer more flexibility with office solutions, including virtual options, which can be more cost-effective for startups.

- Tax Implications: We are in 2024 and there are several levels of taxation involved across Mainland businesses as well as the Free zones. Although the taxation percentile is much lower compared to the other business locations of the world, you as an entrepreneur can be impacted. There are also taxation reliefs provided to small businesses and certain activities in Free Zones – which can significantly reduce overall costs.

The Real Deal: So, What Is the Difference Between Mainland and Free Zone?

This Table Can Help You Decide Which Best Suits Your Business the Best:

Criteria | Mainland | Freezone |

Ownership & Control | Up to 100% foreign ownership (may require a local sponsor for some activities) | 100% foreign ownership |

Nature of Business Activities | Limited to specific groups of related activities | Allows for a wide variety of business activities under one license, even if unrelated. Ideal for innovative projects or international trade |

Licensing Process |

|

|

Office Space | Physical office required (registered with Ejari) | Option to choose between physical or virtual business location |

Visa Requirements | No restrictions on the number of visas | Some restrictions, typically allowing 6-7 visas |

Legal & Regulatory Considerations | Subject to federal and local laws | Self-regulated and often provide tax exemptions and streamlined setup processes |

Market Access | Broader market access, ability to operate across the UAE | Industry-specific support but limited to the free zone’s geographical area unless additional provisions are made |

Corporate Tax Impact |

|

|

Cost Comparison: Free Zone vs Mainland Company Setup in Dubai

Factor | Free Zone | Mainland |

Setup Fee Range (AED) | 10,000 – 30,000+ | 20,000 – 40,000+ |

Minimum Share Capital | Not Required | May Be Required |

Office Space | Virtual Option Often Available | Physical Office Required |

License Fees | Generally Lower | Generally Higher |

Renewal Fees | Annual Fees Apply | Annual Fees Apply |

Visa Costs | Apply | Apply |

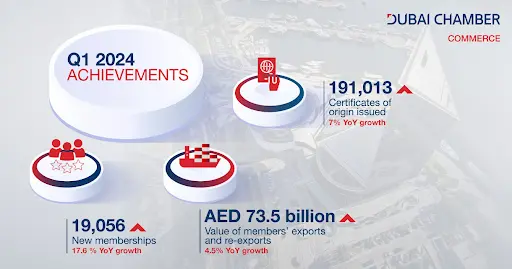

As of the first quarter of 2024, the number of new companies formed in Dubai Mainland and Free Zones is as follows:

As of the first quarter of 2024, the number of new companies formed in Dubai Mainland and Free Zones is as follows:

1. Business Setup in Dubai Mainland