The 3 Major Factors Fluctuate the Cost of Setting Up A Business In Dubai:

- The Legal Structure of Your Company: This refers to the type of business you choose to operate. Common options include sole proprietorship, limited liability company (LLC), and branch office. Each structure has its own formation requirements and associated fees. For instance, an LLC typically involves more paperwork and government registration costs compared to a sole proprietorship.

- The Chosen Jurisdiction: Dubai offers various locations to set up your business, each with its own fee structure. Popular options include the Dubai mainland, free zones, and offshore regions. The mainland allows you to operate anywhere in Dubai, while free zones offer specific benefits and restrictions depending on the zone’s focus (e.g., technology, and media). Offshore regions are typically for businesses not physically operating in Dubai. The cost of company setup is different for each of them.

- Your Business Activity: The kind of business you run also influences the cost. Certain industries may require additional licensing or permits, adding to the overall formation expense. For example, a restaurant would likely have different permitting needs compared to a consulting firm and cost more.

Unveiling Your Dubai Business Startup Costs: A Tailored Approach

Fast-Track Your Cost Analysis:

For a quick and personalized cost estimate, reach out to our team of experts today. We will analyze your specific needs and provide a clear picture of your initial investment.

Delving Deeper: Jurisdiction-Specific Costs

However, if you prefer a deeper dive, let’s explore how your chosen jurisdiction impacts the cost structure. Dubai offers a variety of locations to establish your business, each with unique advantages and cost implications.

We will delve into these options and understand which suits you, your business activity, and your budget the best!

Understanding Business Setup Costs in Dubai: Jurisdictions-wise

Dubai’s diverse business environment offers a range of locations to set up your company, each impacting the initial setup cost. Here’s a breakdown of the three main jurisdictions and their associated costs in AED:

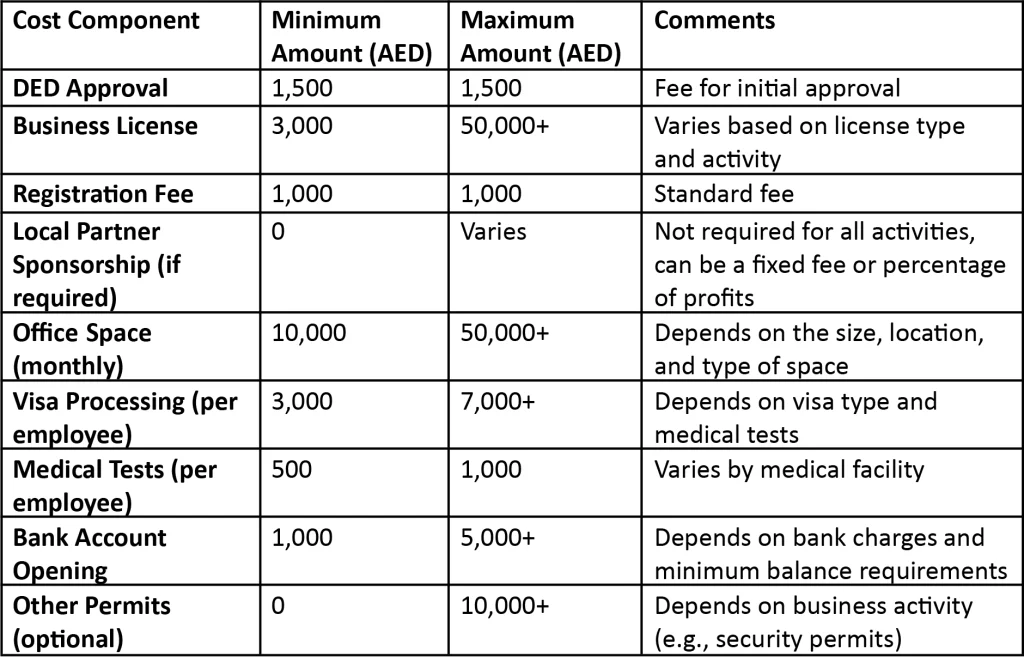

1. Mainland Company: Cost: Moderate to High.

Setting up requires Department of Economic Development (DED) approval and involves fees for licenses, registration, and potentially a physical office space. Expect costs to range from AED 25,000 onwards.

Benefits: Ideal for businesses targeting the UAE market directly. Offers unrestricted business activities and 100% foreign ownership for specific activities within structures like LLCs and Civil Work Companies.

How Much Does Setting Up A Business In Dubai Mainland Cost?

Total Estimated Cost: AED 19,500 to AED 138,500+

Please note: This table provides a general guideline and the actual cost may differ based on your specific business activity and requirements. Additional costs like marketing, insurance, and utilities are not included here. Consulting a business setup specialist from CorpCreators can provide a more accurate cost estimate.

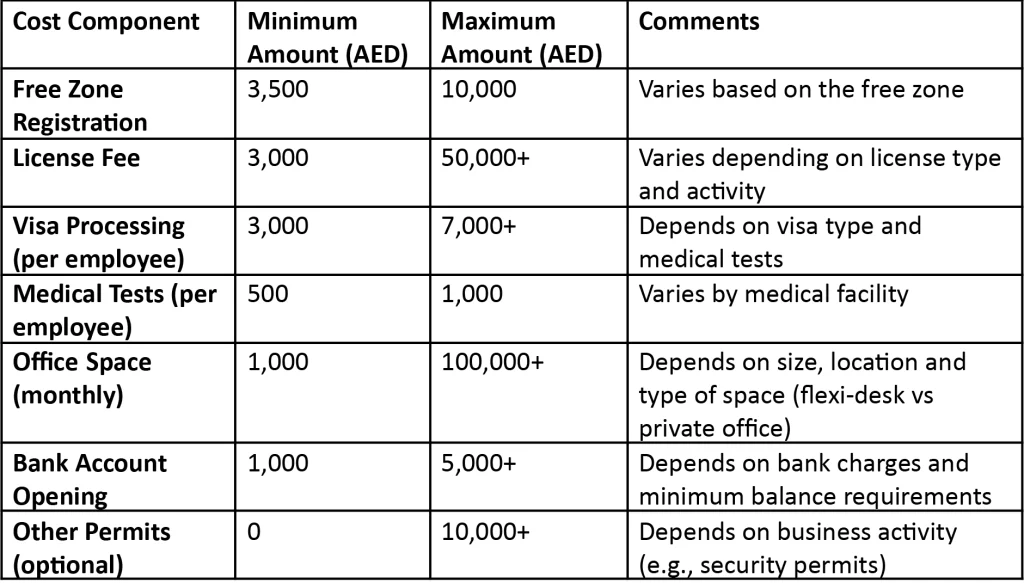

2. Free Zone Company: Cost: Potentially Lower than Mainland.

Free zones offer competitive setup costs, often starting around AED 3,500 for registration. However, annual license renewal fees can vary significantly. Dubai World Trade Center’s license renewal fee, for example, is around AED 5,000, while DMCC might charge upwards of AED 50,000 for a general trading license.

Benefits: Cost-effective option with flexible office space solutions. Some free zones cater to specific industries and offer tax benefits. Remember, some free zones restrict your ability to directly serve the UAE market.

How Does Business Setup in Dubai Free Zones Cost?

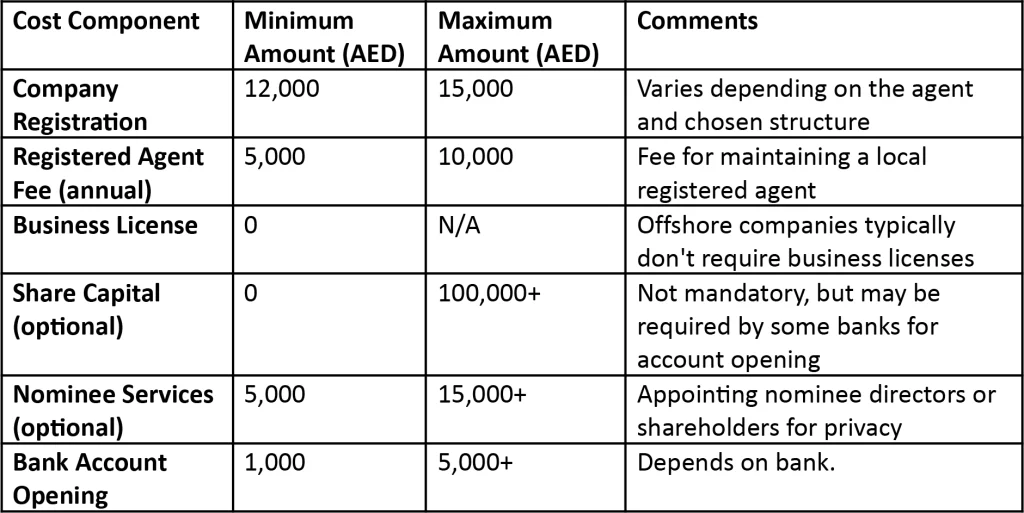

3. Offshore Company: Cost: Moderate.

Setting up an International Business Company (IBC) in Dubai costs around AED 15,500, with additional costs for shared capital and dedicated office space (if required). Annual renewal fees apply.

Benefits: Primarily for asset protection and international transactions. Offshores or IBCs operate outside the UAE’s regulatory framework and offer tax advantages, but cannot conduct business within the UAE.

How Much Do Dubai Offshore Business Setup Costs?

Total Estimated Cost: AED 18,000 to AED 45,000+

Please note: This table provides a general guideline and the actual cost may differ based on your specific needs and chosen service providers. Additional costs like annual license renewal fees for specific activities and auditing (if required) are not included. Consulting a business setup specialist can provide a more accurate cost estimate.

Here are some additional factors that can influence the cost:

- Complexity of company structure: A simple IBC structure is cheaper than one with multiple shareholders or nominee services.

- Bank chosen for account opening: Banks have varying fees and minimum balance requirements.

- Need for nominee services: Using nominee directors or shareholders adds to the cost.

Book A Free Consultation with A Business Setup Expert & Keep Following for More!

Don’t let the initial setup process overwhelm you. Contact CorpCreators today for a free consultation, and let us guide you!

If you enjoyed this breakdown of Dubai business setup costs, keep visiting our website for more informative resources! We offer a wealth of information on company formation, legal structures, industry insights, and more. Get started on your Dubai business journey today!