Let's Check Out the Various Benefits that Make Setting up an Offshore Company in the UAE a Preferred Option.

1. 100 Percent Foreign Ownership

Offshore company setup Offers 100 percent foreign ownership and the ability to open bank accounts in the Emirates. It also gives you immense feasibility in ownership of property in the UAE and overseas.

2. Multi-Currency Accounts

Offshore companies are permitted to open multi-currency accounts in the UAE and carry out business internationally. Multi-currency accounts let you hold your money in one or more foreign currencies within the same account. You might open an account while setting up an Offshore company in the UAE and hold pounds, euros, or any other currency.

3. Incentives on Taxation

The UAE’s new corporate tax and transfer pricing rules add a layer of complexity for Offshore companies, requiring them to assess tax liability, maintain arm’s length transaction documentation, and potentially register, file returns, and pay taxes.

While the UAE introduced corporate tax and transfer pricing rules, there still can be tax incentives for offshore companies:

- Potential tax exemption: Certain businesses or those with minimal UAE activity may be exempt from the corporate tax altogether.

- Tax benefits on global profits: Offshore companies are taxed on their global profits, potentially benefiting from lower tax rates in other countries where they operate.

- No income or capital gains tax: The UAE doesn’t levy personal income tax or capital gains tax on offshore companies.

These factors, combined with the UAE’s ease of setup and strategic location, can make it a compelling option despite the new regulations. However, professional guidance is crucial to navigate these changes. This will optimize your offshore company’s tax structure as well as maximize incentives on taxation.

4. Protection of Property

Individuals wanting to restructure their ownership assets can also consider setting up an Offshore company in the UAE. Offshore company formation provides them with safeguarding themselves in case of lawsuits or outstanding debts. A portion of the property is transferred to people or a legal entity creating avenues that are unsusceptible to seizure.

5. Discretion of Entity

The UAE Offers a business-friendly environment for Offshore company formation. However, companies have to comply with anti-money laundering (AML) and Know-your-customer (KYC) regulations. Nevertheless, the public records do not typically disclose the names of ultimate beneficial owners (UBOs). This can provide a level of discretion for the owner.

Now that You Know the Benefits of Setting up an Offshore Company in the UAE, Let’s Understand How to Form an Offshore Company in the UAE?

The UAE has several jurisdictions that specialize in Offshore companies, with Ras Al Khaimah (RAK) being a popular choice. Here’s a general process for starting an Offshore company in the UAE with CorpCreators:

1. Initial Consultation:

Contact CorpCreators and discuss your business goals and needs. We will advise you on the most suitable Offshore jurisdiction and company structure as per your needs, budget, and business activity.

2. Gather the Required Documents:

- Prepare the necessary documents, we can also help you with the same. All you need to do is submit your:

- Passport copies for shareholders and directors

- Proof of address for shareholders and directors

- Proposed company name(s)

- Business activity description

3. Company Name Approval:

CorpCreators will help you check name availability and secure your preferred company name.

4. Company Formation:

CorpCreators will handle the legal paperwork and registration process with the chosen Offshore authority in the UAE.

5. Bank account Opening in UAE:

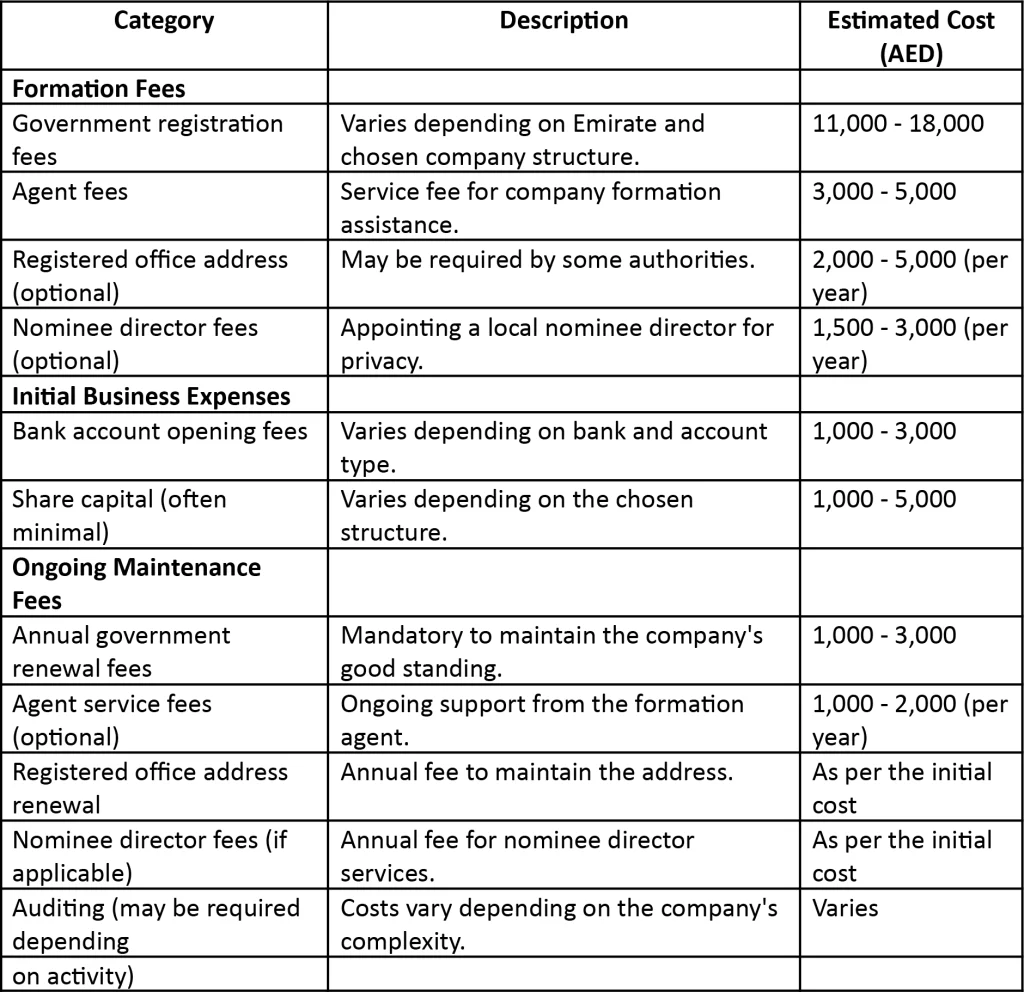

So, What are the Costs Associated with Offshore Company Formation in the UAE?

Important Notes:

- These are estimated costs and can vary depending on the specific Emirate, chosen company structure, etc.

- Additional fees may apply for specific business activities or complex company structures.

- It is recommended to consult with a company formation service or legal professional from CorpCreators for a tailored cost breakdown.

Explore More by Booking a Free Consultation Now!

CorpCreators can help navigate the process and manage complex situations by consulting in-house lawyers and tax advisors specializing in UAE Offshore companies. Want to experience it yourself? Speak to our company formation experts today!